Fast Personal Loans in the US for 2025: Low Credit Finance Full Overview

Updated 2025 Guide to Fast Personal Loans and Low Credit Financing Options Nationwide

New York, Oct. 14, 2025 (GLOBE NEWSWIRE) -- Disclaimer: This article is for informational purposes only. It is not financial advice. Loan terms, rates, and eligibility vary by lender. Always review full details directly on the official website before applying or making financial decisions. This article contains affiliate links. If you purchase through these links, a commission may be earned at no additional cost to you.

With inflation continuing to impact everyday expenses, a recent survey shows that 70% of Americans are facing financial stress. While none of us want to deal with money troubles, unexpected challenges do happen—and when they do, finding the right financial help quickly is crucial.

Unfortunately, many people with low credit scores or poor credit histories often get turned away by traditional lenders, who rely heavily on credit checks. This leaves many Americans stuck without access to needed funds.

To solve this, we’ve put together a list of trusted lenders offering quick personal loans to everyone, regardless of credit score. These lenders provide fast approvals, low APRs, flexible terms, and let you use the money however you need.

If you’re looking for a fast, reliable personal loan, check out our top recommendations below and get funds deposited directly into your account—often within hours.

Recommended Brokers for Quick Personal Loans

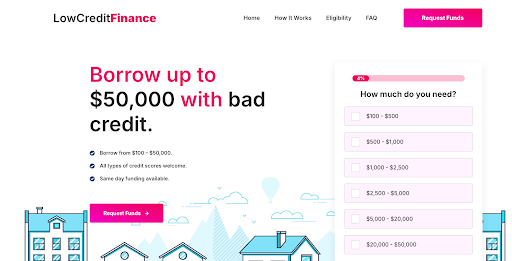

Low Credit Finance – Fast Approvals for Quick Personal Loans

Getting a quick personal loan from Low Credit Finance is simple—even if you’re new to borrowing. They offer loans from $100 to $5,000, with some of the lowest interest rates on the market and repayment plans that work for your budget. Their streamlined application process requires no paperwork and can have funds in your account in as little as 60 minutes.

Why choose Low Credit Finance?

- Welcomes all credit types, including bad credit

- Flexible repayment options

- Low-interest rates

- No paperwork hassle

- Easy online application

- User-friendly platform

They understand the urgency when you need money fast and make the process smooth and transparent.

What Is a Quick Personal Loan?

A quick personal loan is similar to a traditional personal loan but designed to be approved and funded much faster. These loans help cover unexpected expenses or emergencies requiring immediate cash. The convenience comes with slightly higher interest rates than standard loans, reflecting the speed and flexibility offered.

How Quick Personal Loans Work

To get a quick personal loan, you’ll:

- Find a reputable lender that fits your needs

- Submit an application online with basic details

- The lender reviews your eligibility

- If approved, funds are quickly sent to your bank account

Typical requirements include:

- Being a U.S. citizen or permanent resident

- Being 18 years or older

- Proof of income

- Having a bank account

- Valid contact information

Many lenders perform soft credit checks, so your credit history won’t necessarily disqualify you.

Pros and Cons of Quick Personal Loans

Pros:

- Fast access to cash when you need it most

- Easy online application, no long waits or paperwork

- Lenient credit requirements

- Can improve your credit score with timely repayments

- Flexible funding for emergencies, travel, education, and more

Cons:

- Higher interest rates compared to traditional loans

- Less room for negotiating terms

- Risk of falling into debt if not managed carefully

Impact on Your Credit Score

Even though quick personal loans don’t heavily rely on credit checks upfront, how you repay the loan will affect your credit score. Making payments on time can improve your score, while missed or late payments can hurt it. Responsible borrowing is key.

Are Quick Personal Loans Right for You?

If you need fast funds to cover unexpected costs, quick personal loans offer a convenient and accessible solution. Just make sure to assess your repayment ability and choose lenders with fair terms to avoid potential pitfalls.

Final Thoughts

Quick personal loans can be a lifeline for short-term financial needs—whether consolidating debt, managing emergencies, or funding important expenses. With many lenders available, take time to compare rates, terms, and fees to find the best fit. Remember, loans are not just about borrowing money but about managing your financial health responsibly.

Frequently Asked Questions

Are quick personal loans only for emergencies?

No, you can use them for travel, education, business, or other needs.

Can I repay early without penalties?

It depends on the lender—always check loan terms for prepayment fees.

Can I get a quick personal loan if self-employed or with irregular income?

Yes, some lenders consider alternative income proof like bank statements or tax returns.

Are quick personal loans suitable for education?

Absolutely, they can cover tuition, books, and other educational costs.

Can I get a quick personal loan with bad credit?

Yes, many lenders specialize in loans for those with less-than-perfect credit, though rates may be higher.

- Email Support: support@lowcreditfinance.com

- Phone Number: 1-844-870-5672

Affiliate Disclosure: If you apply through links in this article, a commission may be earned at no additional cost to you. Always verify loan terms and lender credentials through the official site.

Financial Disclaimer: This content is for informational purposes only and should not be considered financial advice. Loan products discussed are subject to change based on lender policies, credit review, and state regulations. Always consult a licensed financial professional before borrowing.

Accuracy Disclaimer: Every effort has been made to ensure accuracy at the time of publication. The publisher does not guarantee completeness or future updates of rates or terms. Readers are encouraged to confirm all details directly with the lender.

Publisher Responsibility Statement: The publisher of this content is not a lender, broker, or financial institution. We do not issue credit decisions or loan offers. The information provided is for educational purposes and should not replace independent financial judgment.

Email Support: support@lowcreditfinance.com Phone Number: 1-844-870-5672

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.